Prime Minister Youth Loan Scheme 2025 Eligibility and Application Process

In a nation such as Pakistan, where over 60% of the population is below the age of 30, youth empowerment is not only a policy objective but a national imperative. Acknowledging the potential and energy of young Pakistanis, the government has persisted in its efforts to empower them through numerous initiatives. Among the most influential measures in this context is the Prime Minister Youth Loan Scheme 2025. This trend goes on to indicate the rising optimism of youth to set up their businesses, become self-dependent financially, and help elevate the country’s economy.

Read More: CM Punjab Laptop Scheme Merit List 2025 Check Your Punjab Laptop Scheme Verification

What is the Prime Minister Youth Loan Scheme 2025?

The Prime Minister Youth Business and Agriculture Loan Scheme, reinforced for 2025, is a financial scheme initiated by the Government of Pakistan. Its core objective is to offer subsidized loans to young entrepreneurs so that they can initiate or grow their businesses. Whether it is a student who wishes to begin a small tech startup, a farmer who wishes to invest in advanced machinery, or a female entrepreneur who wishes to open a boutique scheme fulfills all such aspirations.

The 2025 Youth Loan Scheme has been enhanced from previous feedback and economic downturns. It not only provides easy access to funding but also features digital applications, mentorship schemes, and improved monitoring mechanisms to ensure misuse is prevented.

Read More: Chief Minister Punjab Skill Development Program 50+ Courses Latest Updates

Categories and Loan Tiers

The scheme is divided into three tiers to cater to individuals from different backgrounds:

- Tier 1: Loans ranging from PKR 100,000 to 500,000, with zero interest. Ideal for small startups and micro businesses.

- Tier 2: Loans ranging from PKR 500,001 to 1.5 million, offered at a 5% interest rate.

- Tier 3: Loans from PKR 1.5 million to 7.5 million, with a 7% interest rate, for scaling up established businesses.

Eligibility Criteria PM Youth Loan Scheme 2025

Applicants are also encouraged to register with SECP, FBR, or relevant provincial departments to formalize their businesses.

Read More: CM Maryam Skill Development Pehchan Program for Transgenders – Apply

How to Apply for PM Youth Loan Scheme 2025?

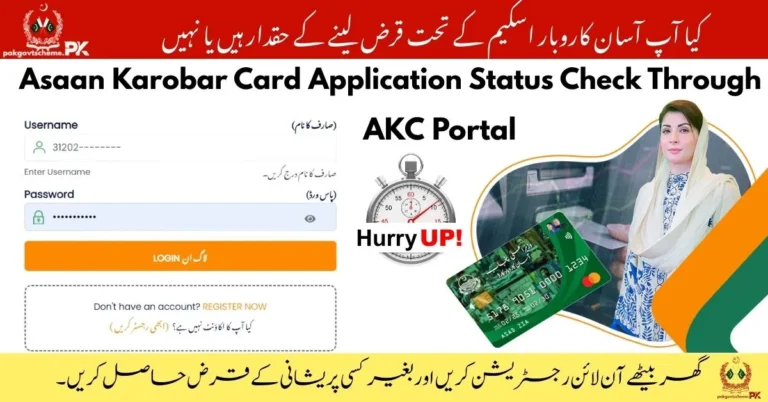

Step 1: Visit the Official Website

Go to the official PM Youth Loan Program Portal: https://pmyp.gov.pk

Step 2: Click on “Apply Online”

- On the homepage, you’ll see a button or menu for the “Youth Business & Agriculture Loan Scheme”.

- Click on “Apply Online” to begin the application process.

Step 3: Fill in the Application Form

You’ll need to provide:

- CNIC number

- Personal details (name, DOB, address, phone, etc.)

- Educational background

- Business information (new or existing)

- Loan amount & tier (Tier 1, 2, or 3)

- Bank selection (e.g., NBP, Bank of Punjab, etc.)

Step 4: Upload Required Documents

You may be asked to upload:

- CNIC (front & back)

- Passport-sized photograph

- Business plan

- Education/skills certificate (if applicable)

- Experience (if any)

Step 5: Submit Your Application

After reviewing your information, click “Submit”.

You will receive a tracking number to monitor your application status.

Step 6: Wait for Processing

The bank will review your application and may call for verification or interview.

You’ll be informed through SMS or email if approved.

Processing Time:

Usually takes 30 to 60 days for approval and disbursement.

Read More: CM Punjab Skilled International Placement Program – Global Job Opportunities

Why Is It Important?

The PM Youth Loan Scheme 2025 is not merely lending loans it is about mindset change. In a nation where the unemployment rate is high, particularly among graduates, PM Youth Loan Scheme 2025 encourages the culture of entrepreneurship and self-employment. It makes youth think outside the box of conventional 9-to-5 employment and generate opportunities not only for themselves but also for others.

This program also bridges rural and urban gap by opening up access for the youth of less developed regions. For instance, a young girl from Lodhran or a lad from interior Sindh can have access to this opportunity as conveniently as the person in Lahore or Karachi.

Challenges and Suggestions

Read More: Registration Process by CM Punjab Free Transplant Program Free Medical Treatments

Conclusion

The Prime Minister Youth Loan Scheme 2025 is a golden chance for the aspiring, the innovative, and the industrious youth of Pakistan. It is a move towards creating a stronger, independent, and innovative nation. But success is not just dependent on the policy of the government but also on the guts of the youth to dream, plan, and act.

If properly utilized, this program has the potential to convert Pakistan’s youth from job seekers to job creators.