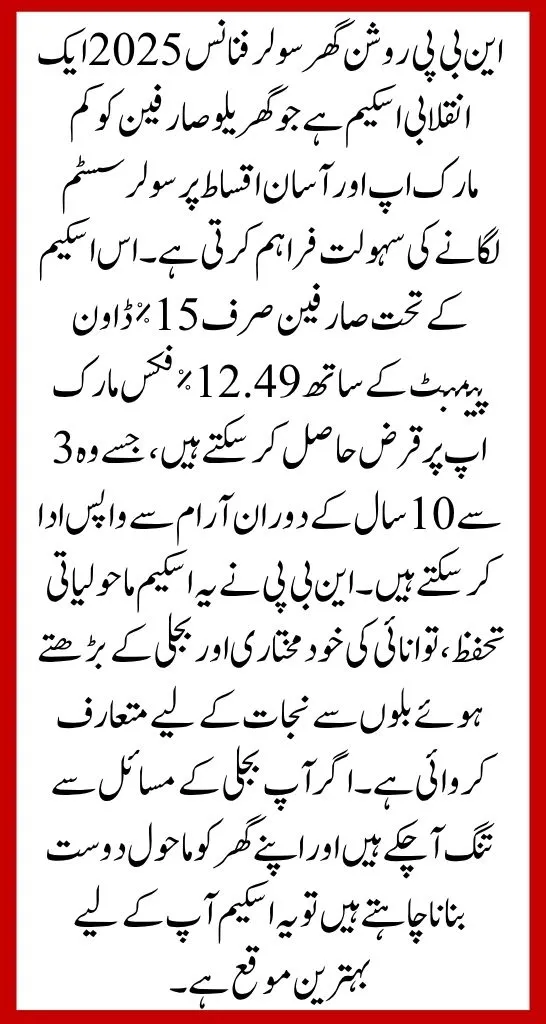

NBP Roshan Ghar Solar Finance 2025 – Affordable Solar Panel Loan in Pakistan

Increasing electricity rates and urgent climate worries have made it so that solar power is now a must rather than a nice extra. The National Bank of Pakistan (NBP) has launched NBP Roshan Ghar Solar Finance 2025 to fulfill this need.

With this solar loan, homeowners can buy solar panels at a lower cost by paying back the loan with a fixed 12.49% rate and flexible repayment times. If you are interested in financing a solar project in Pakistan, this guide includes all the details you need – from meeting the requirements to the benefits involved, the process and frequently asked questions.

What is NBP Roshan Ghar Solar Finance?

The purpose of NBP Roshan Ghar Solar Finance 2025 is to aid Pakistani homeowners in powering their homes with solar energy and provides interest loans so the costs can be paid off over time. Clients can use either Islamic or conventional bank financing through the scheme which means more people can benefit.

The scheme helps you use solar energy to lower your electricity bills or achieve complete energy independence without putting stress on your budget.

Key Features of NBP Roshan Ghar Solar Loan Scheme

Here are the top features that make this scheme one of the best solar panel financing options in Pakistan:

| Feature | Details |

|---|---|

| Loan Type | Islamic & Conventional |

| Markup Rate | 12.49% (fixed for the first 2 years) |

| Financing Limit | Up to PKR 5 million |

| Tenure | Flexible – up to 10 years |

| Down Payment | As low as 15% |

| Certified Vendors Required | Yes (SBP-approved solar system providers only) |

Eligibility Criteria for NBP Roshan Ghar Finance

You can apply for this solar financing scheme if you meet the following criteria:

- Pakistani National with a valid CNIC

- Must be a homeowner (property ownership required)

- Must have a stable income (salary slip or business proof)

- Clean credit history with no major loan defaults

- Residential property only – commercial applications not allowed

The Process of Applying for NBP Roshan Ghar Solar Finance

- Go with a solar vendor that has been approved by SBP.

Select vendors who are listed by the State Bank of Pakistan. You will be able to find the list on the SBP website. - Having a specific solar quotation is very helpful.

Request that the vendor give you a complete price quote, covering all parts.

- Solar panels

- Inverters

- Any batteries that are part of the product

- Installation charges

- Go to your nearest branch at the National Bank of Pakistan.

Send the necessary paperwork:

- Duplicate CNIC

- The last couple of electricity bills

- Using a vendor from the approved list

- Necessary documents to show where income came from

- Evidence that one is the owner of land or buildings

- The process of getting a loan approved.

NBP will go through all your documents. When the application is approved, the vendor gets the money and the installation starts.

5.Start Repayment

After a grace period of 1–3 months, you’ll start monthly repayments. Tenure options range from 3 to 10 years, depending on your choice.

Key Benefits of Going Solar with NBP

Significant Reduction in Electricity Bills

With solar panels, you’ll rely less on the national grid, cutting your monthly bills dramatically.

Eco-Friendly Energy

Solar power is renewable and helps reduce your carbon footprint.

One-Time Investment, Long-Term Savings

Although there’s an initial cost, solar pays back over time and increases your home’s value.

Secure Financing from a Reputed Bank

NBP is a trusted name, ensuring your loan is processed professionally and securely.

Support from Government & SBP

The scheme is backed by regulatory oversight and approved vendors, ensuring quality assurance.

Latest Posts

- CM Punjab E-Taxi Scheme 2025 – How to Register, Pay, and Get Approved

- Benazir Hunarmand Program 2025 – Free Technical Skills for BISP Beneficiaries

- How to Apply for Hunarmand Program 2025 – Complete Guide

- NSER Survey 2025: How to Update CNIC & Biometric for BISP Registration

- CM Maryam Nawaz Unveils Rs. 811.8 Billion Education Budget for 2025–26

Final Words

NBP Roshan Ghar Solar Finance 2025 is more than just a loan — it’s a step toward energy independence, financial freedom, and environmental responsibility. With affordable markup rates, flexible payment terms, and the support of certified vendors, NBP is making solar energy a reality for thousands of Pakistani families.

Don’t miss the opportunity to cut down your electricity bills, protect the environment, and increase the value of your home. Whether you live in urban or rural Pakistan, this scheme can help bring light literally to your future.