CM Punjab Launches Rs. 70 Billion Asan Karobar Loan Scheme 2025 to Empower Entrepreneurs

Punjab’s Asan Karobar Loan Scheme 2025 brings a historic Rs. 70 billion to uplift small business owners across the province. Chief Minister Maryam Nawaz Sharif has emphasized inclusive economic growth by offering interest-free loans, digital access, and youth support. This initiative aims to ignite entrepreneurship in both urban and rural areas.

What is theAsan Karobar Loan Scheme 2025 and Who Is It For?

The Asan Karobar Loan Scheme 2025 is a pioneering effort to offer small enterprise support at scale. Designed to empower youth, women, and skilled workers, it offers an accessible financing source for startups and expanding ventures. By eliminating interest charges, this scheme removes a major barrier to entry for many aspiring business owners.

This program targets micro and small businesses with turnover under Rs. 800 million. It opens doors for those with active tax status to receive structured capital. The blend of simplicity and substantial funding makes it an attractive option for rural entrepreneurs and city-based self-starters alike.

Read More: Maryam Nawaz Sets Record Rs. 129.8 Billion Agriculture Budget for Punjab 2025–26

Key Features of the Rs. 70 Billion Asan Karobar Loan Scheme 2025

Asan Karobar Loan Scheme 2025 is structured around interest-free loans ranging from Rs. 50,000 to Rs. 1,000,000 with flexible repayment over 12 to 36 months. These terms give borrowers breathing room to grow and stabilize. The government has emphasized convenience, transparency, and speed in its loan disbursement strategy.

Another standout feature is the fully online registration system. Applicants can establish accounts, upload documents, and track loan progress via the official Punjab portal. This digital model reduces red tape and welcomes remote access, ensuring support reaches both town and remote village entrepreneurs.

Read More: Pakistan Budget 2025-26: Key Highlights & Sector-Wise Analysis

Eligibility Criteria for Punjab Entrepreneurs in 2025

To qualify, applicants must fall between ages 25 and 55, hold a valid CNIC and NTN, and reside in Punjab. Additionally, being an active tax filer is mandatory to ensure fiscal compliance. Their business must be a legitimate micro or small enterprise operating under legal oversight.

These criteria aim to balance accessibility and accountability. By focusing on job-creators and self-reliant individuals, the scheme leaves out multiple benefit seekers. It verifies identities using official databases, minimizing fraud and emphasizing trust in the system.

Read More: New School Nutrition Initiative Gets Rs 7B for School Meal Program 2025-26

How to Apply for the Asan Karobar Scheme 2025

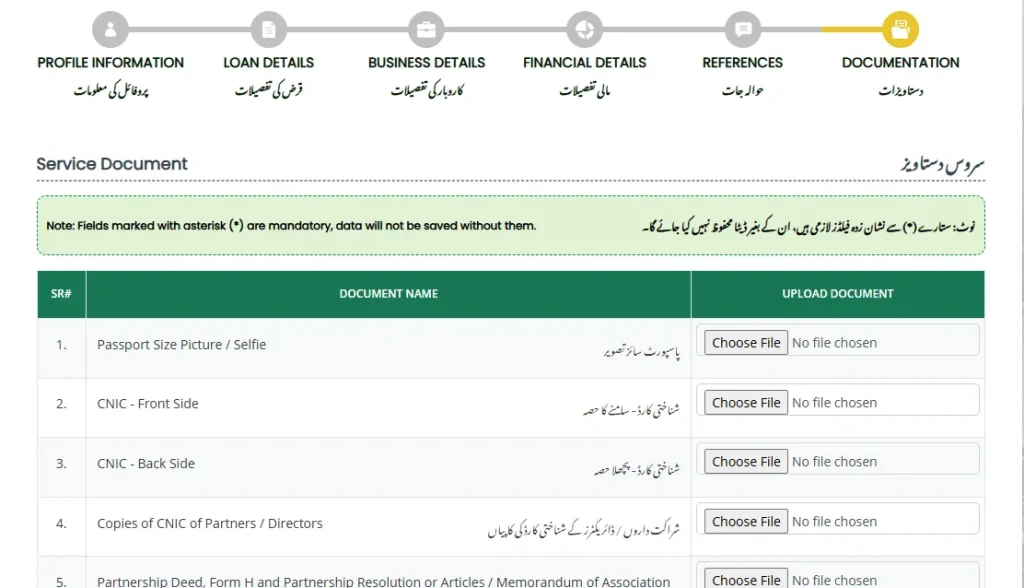

To apply, sign up at https://akf.punjab.gov.pk/login using a valid mobile number linked to your CNIC. Applicants then upload scanned CNICs, tax proof, business plans, photos, and two non-relative references. The portal guides users through each step with prompts.

The portal also offers support via call centers and help desks. Farmers in remote districts who don’t have internet access can get assistance at local e-service centers. This hybrid model ensures both tech-savvy and traditional users can access the program.

Read More: Honhaar Scholarship 2025-26: CM Punjab Allocates Rs 15 Billion for Youth Empowerment

Loan Amount Categories and Repayment Options

Below is a clear breakdown of the loan slabs and repayment expectations:

| Loan Amount | Repayment Period | Monthly Installment (Estimated) |

|---|---|---|

| Rs. 50,000 | 12 months | Rs. 4,167 |

| Rs. 200,000 | 24 months | Rs. 8,333 |

| Rs. 1,000,000 | 36 months | Rs. 27,778 |

This table helps applicants plan finances effectively. Borrowers can select amounts and terms that align with their business needs.

Why This Scheme Matters for Economic Growth in Punjab

By injecting capital into emerging businesses, the scheme is poised to reduce unemployment and promote grassroots economic growth. When entrepreneurs grow, they hire staff, buy supplies, and contribute to wider economic activity. This creates a cycle of growth rooted in local communities.

Similar models like India’s Mudra Yojana have shown that small loans spur business creation and rural prosperity. Such programs boost financial inclusion and help the informal sector transition into the formal economy. As Punjab embraces modernity, this scheme offers a critical thrust to economic resilience.

Read More: CM Punjab Bikes Scheme for Students – Online Registration

Empowering Women and Youth with Financial Independence

Importantly, the Asan Karobar Loan Scheme 2025 places special emphasis on supporting women-led businesses and youth entrepreneurs. Women entrepreneurs gain access to financing and training, helping them break traditional barriers. Meanwhile, young graduates and skilled workers can turn their ideas into startups with minimal capital constraints.

This focus on gender-inclusive and youth-led growth resonates with global development goals. It ensures that marginalized voices are part of Punjab’s economic narrative, bringing fresh perspectives and innovation.

Common Mistakes to Avoid While Applying for the Asan Karobar Loan

During application, many forget to verify that their CNIC-linked mobile number is active or mistakenly upload expired tax documents. These errors can cause delays or rejection. Always double-check that your NSER or proof-of-filer status matches downloadable records before submission.

Another frequent error is missing reference information or failing to include a clear business plan. Applicants must provide thorough, coherent descriptions of their project, which helps evaluators assess viability. Precision and accuracy speed up approvals.

Read More: Rs. 3.5 Billion Allocated for Minority Card – Budget 2025–26

Long-Term Vision Behind the Asan Karobar Initiative

Chief Minister Maryam Nawaz’s vision centers around transforming Punjab into a hub of SME-led prosperity. By supporting small business ventures, she aims to lower unemployment, raise incomes, and foster innovation. This budgetary focus on entrepreneurship marks a shift from subsidies to sustainable opportunity.

Asan Karobar Loan Scheme 2025 complements other government efforts like the Honhaar Scholarship, Green Credit Scheme, and Livestock Support Cards. Together, these programs create a supportive ecosystem where education, agriculture, and entrepreneurship converge.

Public Reaction and Feedback on the Scheme

Initial response has been optimistic, with many sharing relief on social media about the chance to start businesses without debt burdens. The Lahore Chamber of Commerce praised the scheme as a step toward reducing youth unemployment. Yet, some experts voiced concern over the speed of execution and local branch support.

Such feedback highlights both promise and challenge. As systems scale, the need for robust oversight, timely disbursement, and localized assistance will determine real success.

Read More: CM Punjab Maryam Nawaz E-Taxi Scheme 2025 – A Comprehensive Guide to New Updates

Final Thoughts

The Asan Karobar Loan Scheme 2025 is more than just funding—it’s a lifeline for new businesses rooted in inclusivity and accountability. With a powerful mix of money, technology, and mentorship, it can uplift communities and set Punjab on a path of self-sustained growth.

For this vision to succeed, continued monitoring, timely disbursement, and nurturing of grassroots innovation are essential. If implemented well, this scheme could serve as a template for public-driven economic transformation.