Asan Karobar Card Loan Scheme 2025 by CM Punjab Maryam Nawaz

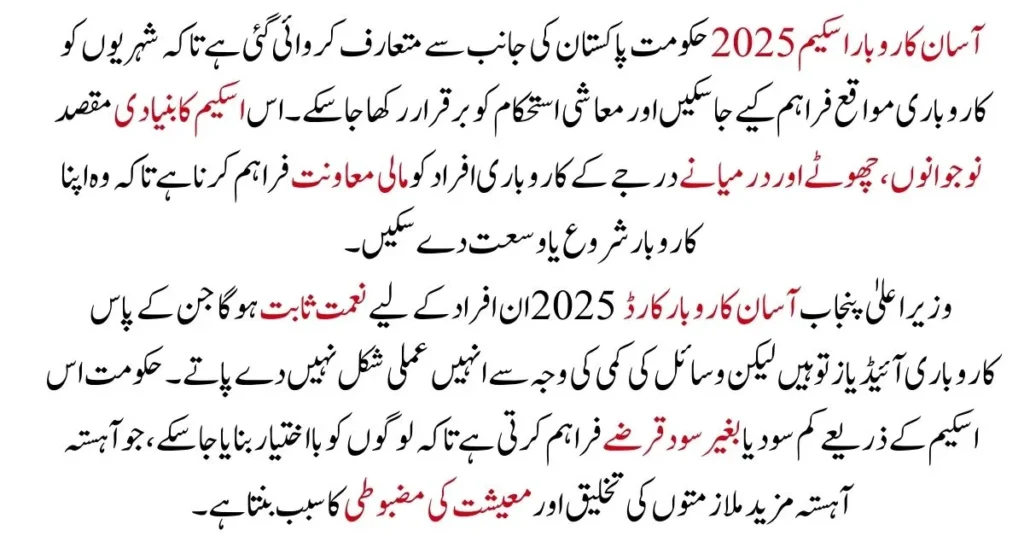

The Asan Karobar Scheme 2025 is introduced by the Government of Pakistan to provide business opportunities for its citizens and to maintain economic stability. The main motive behind this scheme is to promote youth, small, and medium-sized entrepreneurs by giving them some financial support for starting or expanding their business.

Read Also More: How To Apply for CM Punjab Laptop Scheme 2025

CM Punjab Asan Karobar Card 2025 will prove to be a boon for those who have a business ideas but who cannot turn them into practice due to lack of resources. The Government promotes this with low-interest or interest-free loans and empowers people as this gradually leads to more jobs, and the economy within the nation begins to strengthen.

Purpose of this Scheme

Applicants face no difficulty in the online registration process being very simple and clear. This government initiative aims to ease financial pressure and cultivate a strong entrepreneurial environment. Asan Karobar Card scheme just might be the opportunity you need to find success in the world of business.

Asan Karobar Card Scheme 2025:

| Key Features | Details Asan Karobar Card |

| Maximum Loan Limit | PKR 30 million |

| Interest Rate | 0% |

| Loan Tenure | 5 years |

| Grace Period | 3 months |

| Loan Type | Revolving credit facility |

| Application Process | Online via akc.punjab.gov.pk |

Read Also: Eligibility Criteria CM Punjab Negahban Ramzan Program 2025

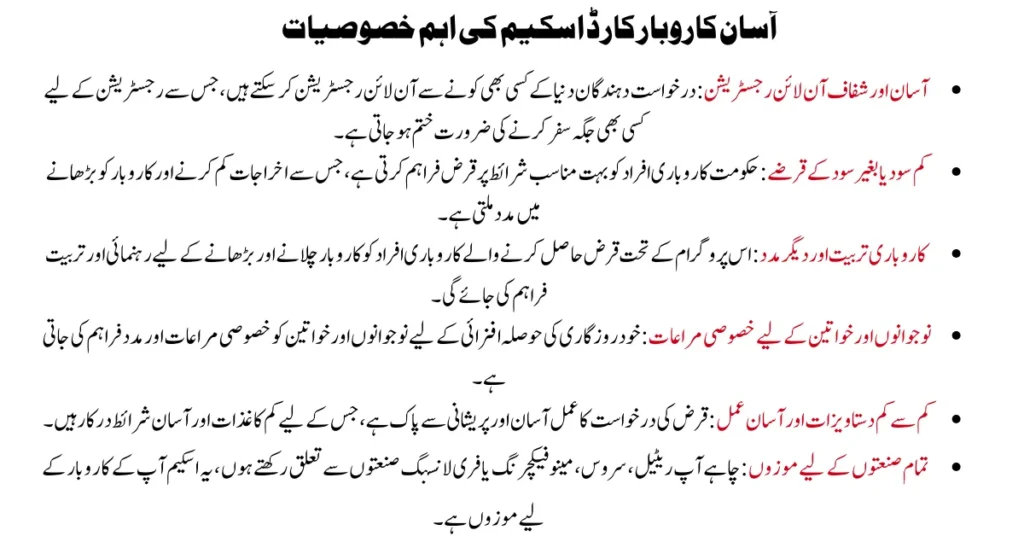

Key Features of the Asan Karobar Card Scheme:

✅ Simple and Clear Online Registration: Applicants are able to register online from anywhere in the world, eliminating the time and effort required to travel to a physical location to perform registration.

✅ Low-Interest or Interest-Free Loans: The government lends business owners money at very affordable terms, helping them cut costs and expand.

✅ Instant Loan Approval: A system based on digital technology ensures swift processing and approval of loan Asan Karobar Card.

✅ Business Training and Other Support: Loans guidance and training to help them operate and grow their businesses affect The program will provide entrepreneurs who receive lively.

✅ Special Incentives for Youth & Women: To encourage self-employment, special promotions and support are provided for youths and women.

✅ Minimal Documentation & Simple Process: The loan application process is simple and hassle-free with less paperwork and easy requirements.

✅ Applicable across: Industries whether you belong to the retail, service, manufacturing, or freelancing industries, the scheme will fit right in your business.

Read More: Eligibility Criteria CM Punjab Negahban Ramzan Program 2025

Eligibility Criteria Asan Karobar Card:

Pakistan Citizenship:

- The applicant should be a Pakistani Citizen holding a valid CNIC.

Age:

- The age of the applicant at the time of application must be between 18 and 50 years.

Plans to Own a Business or Start One:

- Applicant needs to be running a SME (Small Medium Enterprise) or looking to start a new business.

- Freelancers, startups and self-employed individuals are eligible as well.

No Criminal Record:

- The applicant should not have a criminal record with no involvement in any kind of financial fraud or illegal activity

Read Also: CM Punjab Business Finance Scheme and Business Card Scheme 2025

Step-by-Step Registration for Asan Karobar Card:

Step 1:

🔹 Click on the “Register Now” or “Apply Online” link on the homepage to apply.

🔹This link will direct you to the application form.

Step 2: Fill in Your Personal Information

🔹Give your CNIC (Computerized National Identity Card) number.

🔹Write your full name according to your CNIC.

🔹Enter your mobile number (the one used for your Facebook account) and the email address (if any).

🔹Prepare a strong password for future login.

Step 3: Filling Out Business Information

🔹Choose whether you are a new business owner or an established business.

🔹Fill in information about your type of business, industry and projected revenue.

🔹Upload any necessary documents, such as business registration certificate (if applicable).

Steps 4: Upload Required Files

These are the documents you need to scan and upload:

🔹 Copy of CNIC

🔹 Proof of residence (utility bill or rental agreement)

🔹 Business plan/business proposal (if new business)

🔹Bank account for loan disbursal

Step 5: Check and Submit Your Application

🔹Double-check all the information you have filled in.

🔹All documents should be legible and uploaded accurately.

🔹Press the “Submit Application” button.

Step 6: Confirm Receipt and Check Status

🔹Upon completion, you will receive a confirmation SMS or Email with a unique reference number.

🔹You can use this number to check your status on the website.

Step 7: Wait for Approval & Loan Disbursement

🔹The review will be done by the authorities.

🔹If you are approved, you receive information about your loan amount, repayment terms and disbursement process.

Benefits of the Asan Karobar Card Scheme 2025

✅ Loan Disbursement in Just 48 Hours: The fast-track approval system ensures that only the eligible applicants are selected and the loan is disbursed smoothly within 2 days, allowing you to invest into your business without any delay.

✅ Youth and Women Empowerment: The scheme emphasizes young entrepreneurs and women will have special provisions to ignite in the business sector and deliver self-employment.

✅ Flexible Repayment Options: Loan repayment terms are affordable & flexible, so the borrower can pay it off easily without financial burden.

✅ Multi-Sector Business Sector Compatibility: The scheme applies to retail, manufacture, service, freelancing, startups and so on.

✅ Guarantees By The Government: As the loans are government-backed, the applicants can apply for the same without the fear of holding excessive collateral.

Conclusion:

Launched by the Government of Pakistan, the Asan Karobar Card Scheme 2025 is a transformative opportunity aimed at facilitating small and medium entrepreneurs with either low-interest or interest-free loans. The whole process takes place online with easy registration solutions making it economical for business owners, freelancers, and start-ups to get access to business loans.